NPL Outlook Europe 2021

Executive Summary

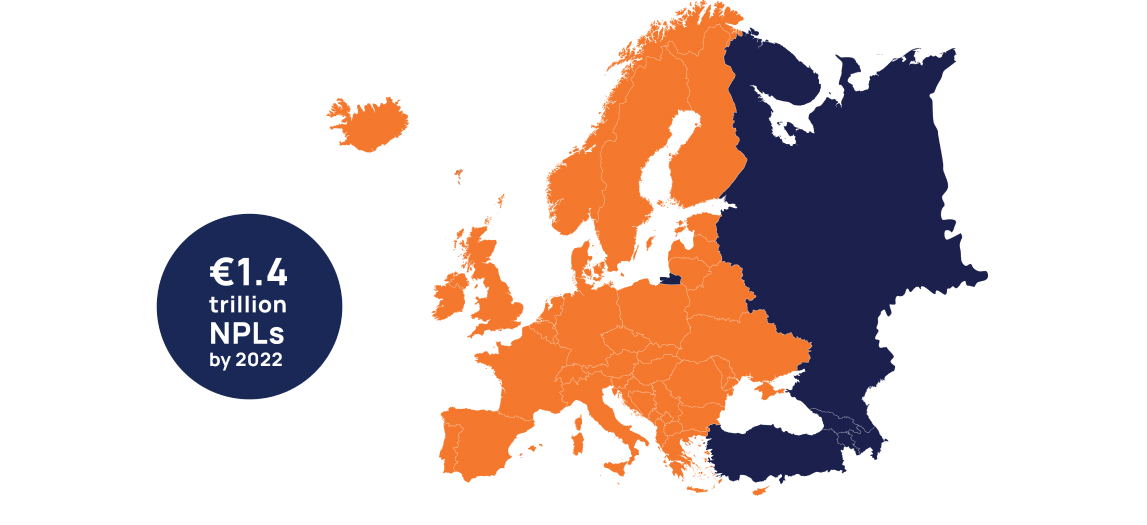

Being several months into an economic downturn brought by the emergence of the pandemic, an accumulation of non-performing loans (NPLs) is expected in Europe that is projected to hit €1.4 trillion by the end of 2022. However, the various job retention schemes and business protection measures are masking the true magnitude of the coming crisis and the veil will be lifted only when furlough and moratorium schemes conclude.

When the support will have been withdrawn, account receivables will be placed under severe stress and businesses can expect to see arrears, provisions and bad debt levels increase at unprecedented rates.

Table of Contents

- Macroeconomic view

- Global Depth

- Private Depth

- NPL Transactions in Europe

- NPL Stock Volume

- NPL loss simulations

- Technology drivers in NPL management

- Europe: latest regulatory policy measures

- Eu NPL outlook 2021 and beyond

- Conclusions

Clearing legacy NPL stock while preparing for the new crop

It becomes apparent that to keep liquidity, it is necessary to clear now those legacy impaired assets stemming from the global financial crisis, preparing for the new crop of pandemic-related NPLs.

Lenders have realised they need a more proactive approach to NPLs. For that, they need advanced digital, self-service, and analytics technology. But those tools are often missing. Therefore, their current ability to manage NPLs now needs to improve, and fast.

Discover the full report here

The article was prepared by QUALCO.